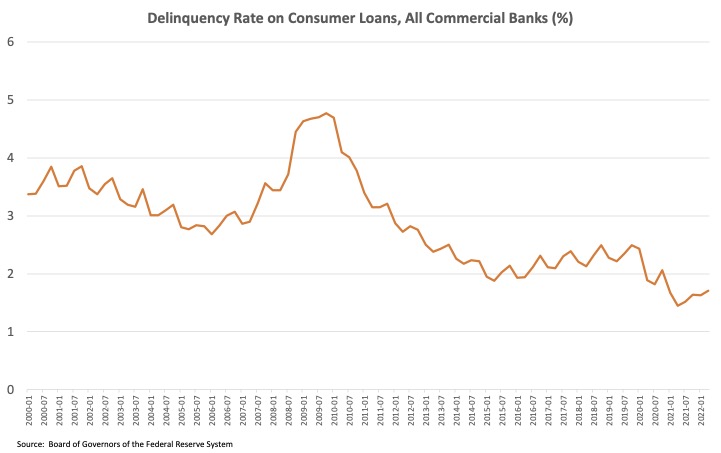

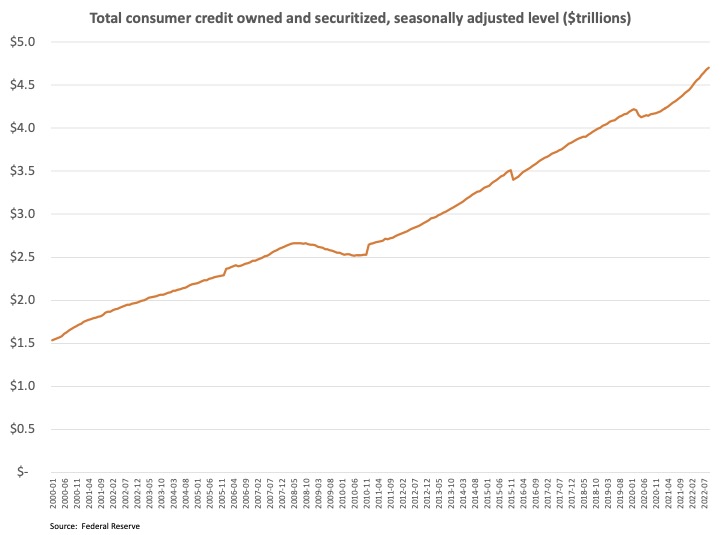

The last two years have been very favorable for credit servicing with defaults at multi-year lows and consumers that have reserves resulting from a combination of a strong jobs market, stimulus payments, and payment moratoriums. In the aftermath of the 2008 credit crisis, underwriting standards tightened adding some of the highest quality debt to most institutions’ balance sheets. This environment has allowed credit servicers to focus on performing accounts and limited the volume of non-performing activities.

An inflection point may be at hand.

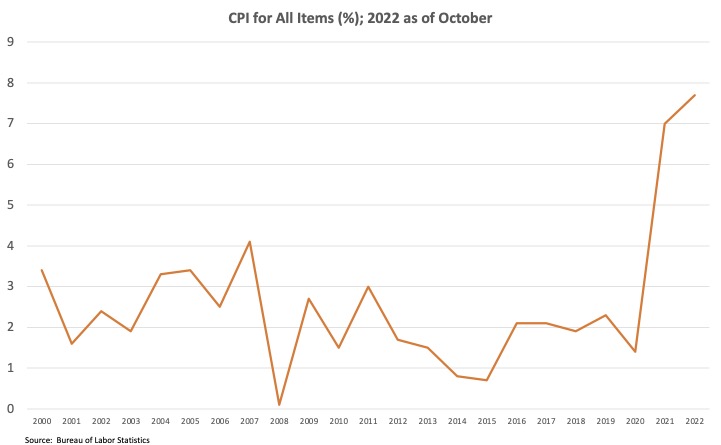

While we have previously noted that market and policy conditions suggested credit challenges were imminent, there have been interventions to prevent a deterioration in credit quality, including extensions on student debt repayment and pandemic related moratoriums. The labor market has also remained unusually strong. The student debt payment moratorium is scheduled to expire in December and there have been several downsizing announcements in recent days, especially in the technology sector. These trends coupled with elevated inflation and rising borrowing costs could start to put pressure on consumers that are already drawing more heavily on credit lines.

A high-level review of operations will help identify areas of potential risk and allow managers to refamiliarize themselves with processes that have been rarely exercised in recent years.

Here is a plan to get you started.

Review volume estimates and capacity plans: as volumes have remained low, it is likely that roles have been combined, outsourced, or otherwise adjusted and must now be revisited to establish the true capacity of the organization. Review your projections and related capacity plans to determine how much additional volume can be absorbed under the existing model and compare this with stressed volume scenarios.

Ensure policies, procedures, training, and controls reflect the latest regulatory guidance: in the last two years changes have been made to TILA, HMDA, and FCRA among others. Review your documentation and change programs to confirm which requirements have been implemented and successfully exercised/tested and which are outstanding.

Evaluate vendor readiness: many vendors that support delinquent loan processing have experienced several years of reduced volume, resulting in some market exits and consolidations. Open a dialogue with your service providers to discuss projected volume scenarios, vendor capacity, any activities required to prepare for elevated volumes, and confirm established policies and procedures.

Prepare for refresher training: once policies, procedures, and training materials have been updated and exercised/tested, identify potential staff that can be reallocated to support increased volumes, and determine the effort that will be required to transition them from current roles.

Each institution is unique and most will require additional activities to prepare for a deteriorating economic environment. It is important to start the process early and prepare for a variety of scenarios.